The year 2024 is predicted to be a bright one for Indonesia's consumer sector.

Why? Because consumer confidence is bouncing back, especially with retail sales showing strong growth.

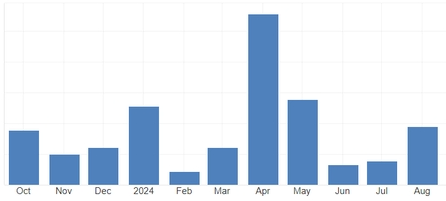

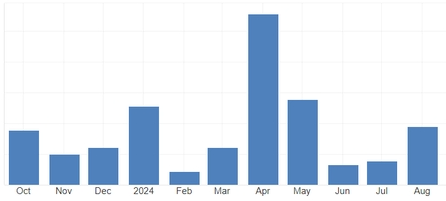

Indonesia Consumer Confidence

Source: Trading Economics

We’re seeing people feeling more confident about spending now.

Maybe it’s because the economy is stabilizing, so they feel secure buying not only daily essentials but also secondary and even luxury items.

This is great news for companies in the consumer sector, as increased spending means higher potential revenue for them.

The rise in consumer confidence didn’t happen overnight.

Many factors have played a role, from a more favorable economic environment to government efforts to boost purchasing power.

With this momentum, the consumer sector is bound to stay in the spotlight, especially if this positive trend continues throughout the year.

One company set to benefit from this positive catalyst is MYOR.

MYOR indicates double-digit revenue growth, one of the highest among consumer companies.

What’s driving their success? Strong demand, both domestically and in export markets, has fueled this performance.

They’re also optimistic about maintaining this positive trend, with long-term sales growth targets in the 12-15% range.

All of this has been supported by the launch of new products and their new wafer and biscuit factories.

Looking at MYOR’s journey since 2019, they’ve been consistently expanding their premium product lines.

What’s the result? Their GPM has risen to an average of 27% between 2019-2023, compared to 25% in 2014-2018.

This premiumization strategy aims to boost profitability while strengthening their market position.

Although there might be some pressure in 2H24 due to rising coffee and cocoa prices, MYOR remains confident they can maintain margins above 25%.

They’ve got a few tricks up their sleeve, like raising prices or adjusting product sizes, to keep their margins intact.

On average, we can expect GPM to stay around 26.6% over the next five years.

Besides that, MYOR has also gotten better at managing operational costs.

They plan to lower their A&P to sales ratio to 8-9%, down from the previous average of 11.3%.

Hopefully this will help drive their earnings growth going forward.

One of MYOR’s biggest growth engines is packaged food.

Their new wafer and biscuit factories play a key role here, boosting their market share in biscuits to 42% and wafers to 25%

Not only that, MYOR has boldly entered a new market: soft candy, with the launch of 'Fruta Gummy.'

Previously known for their hard candy, they’re now tapping into the less crowded soft candy market.

The result? They’ve secured the second spot in the candy category with a 20% market share.

This shows that MYOR still has significant growth potential ahead and the outlook for MYOR looks even more promising.

We expect the company to post solid profit growth, with a projected CAGR of around 13% over the next five years.

With all these factors in play, MYOR’s net profit is projected to reach IDR 3.4 tn in 2024 and rise to IDR 3.8 tn in 2025, reflecting annual growth of 5.5% and 13.3%, respectively.

We maintain our BUY recommendation with a target price of IDR 3,300.

Comments