On January 6, 2025, shares of PGAS experienced a significant increase, closing at

IDR 1,710, up from IDR 1,595 on January 3, 2025. This

7.2% rise was largely attributed to reports suggesting that the Indonesian government might not extend the gas price cap policy (HGBT), which had previously limited the selling price to

$6.0/MMBTU. The potential removal of this cap would allow PGAS to sell gas at market prices, ranging between

$9.0 and $10.0/MMBTU, thereby enhancing profitability. After the government commence HGBT policy, PGAS’s distribution margin fell to $1.8/MMBTU in 2023, compared to an average of $3.0/MMBTU before the HGBT policy was introduced. Investors responded positively to this development, anticipating improved financial performance for the company.

The government has yet to finalize its decision on whether to extend HGBT policy,

which expired in December 2024. The current discussion focuses on adopting a more selective approach to beneficiary industries based on the policy's effectiveness.

Our analyst's sensitivity analysis indicates that for

every $1.0/MMBTU increase in the ASP of gas distributed under the HGBT policy, PGAS’s net profit could rise by 31%, and its dividend yield could improve by 3%. Should the gas distribution ASP revert to

pre-HGBT levels of $9.0/MMBTU, the 2025 forecasted net profit could reach IDR 599 billion (+74% YoY), with the dividend yield increasing from

9% to 16%. Under this scenario, PGAS’s target price could rise from

IDR 1,950 per share to IDR 3,290 per share, reflecting substantial upside potential.

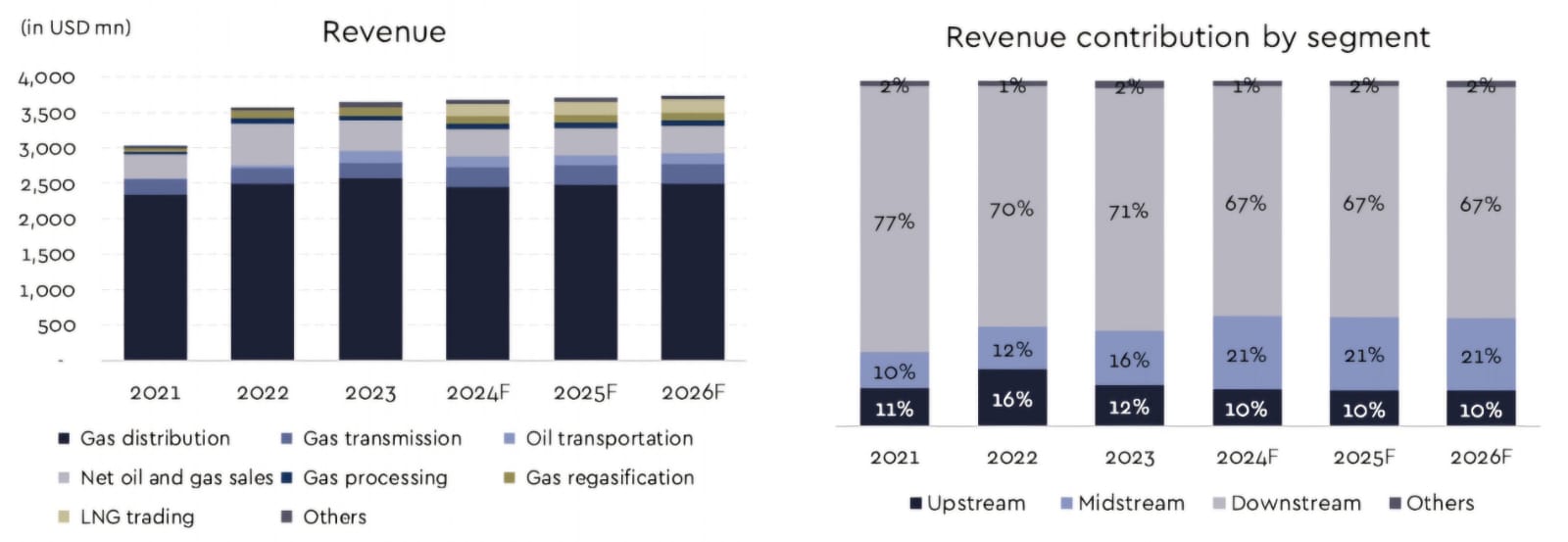

PGAS maintains a strong balance sheet with a net DER of 0.1x and an average free cash flow of $751mn over the past three years. This financial strength enables the company to offer an attractive dividend yield, projected at

9% for 2025, assuming a 70% payout ratio. Moreover, PGAS is expected to achieve a net cash position by 2025, supported by minimal medium-term capital expenditure requirements and strong annual free cash flow generation, which is forecasted to average $552 million from 2024 to 2026.

In our view, PGAS remains attractive for investors considering a long-term position. Should the government decided to stop the HGBT policy, we see that PGAS's margin would soar which then boost its share price to go higher as well. However, if the the HGBT policy resumed by the government, PGAS would need more catalyst to continue its rally.

That said, we reiterate our BUY rating with a DCF-based target price of IDR 1,950, representing 9.1x and 2.9x 2025F P/E and EV/EBITDA, respectively. PGAS remains attractive due to its stable business operations, robust dividend yield, and strong cash flow.

Additionally, the potential discontinuation of the HGBT policy provides substantial upside to profitability and valuation, reinforcing PGAS as a compelling investment opportunity if it actually commence.

.jpeg)

.jpeg)

Comments