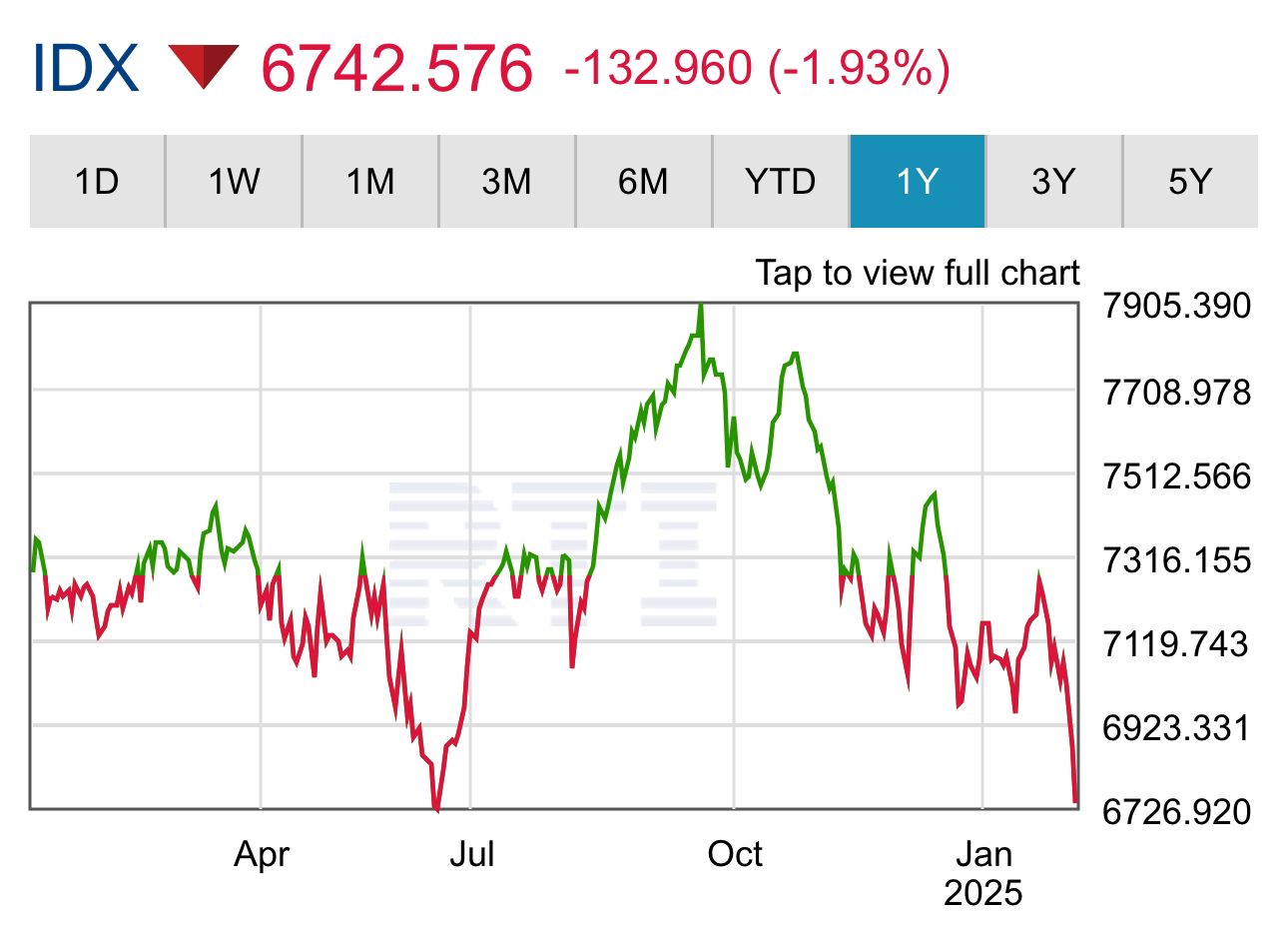

Last week was

brutal for the JCI,

a total bloodbath. The Indonesian stock market closed in the red on Friday, inching dangerously close to

its lowest point in the past year. We at the trading desk were practically on our knees, praying it wouldn’t hit a new 1-year low.

We can’t help but wonder, why is the JCI getting punished so badly this year?

Foreign investors seem to have practically ghosted Indonesian stocks.

Some say it’s because Indonesia is just too small a player. Apparently, the

MSCI allocation for Indonesia is less than 2%. But hey, if it’s so insignificant, why even bother selling, right?

Take my friend, for example. He joined the

e-IPO for RATU and only got allocated 3 lots. That’s just

IDR 345k worth of shares.

When RATU skyrocketed five times its IPO price, I asked him, “

So, have you sold it yet?” He shrugged and said, “

Why bother? Five times IDR 345k is peanuts compared to five times IDR 1 bn.” Fair point.

He also mentioned hearing rumors that the price would go even higher. I said, “

You know those are just rumors, right? What if they’re wrong?” He laughed, “

If they’re wrong, so be it. My max loss is just IDR 345k. I’m willing to bet it all.”

Fair enough, sometimes it’s not just about the math but the thrill of the game.

Using my friend’s point of view,

foreign investors shouldn’t even bother selling Indonesian stocks either, right? It’s probably just a

tiny blip in their massive portfolios. Barely worth the effort.

I brought this up to my friend, and he jokingly said, “

Maybe it’s because Indonesia doesn’t have enough good rumors. I’m holding onto RATU because, first, I only got a tiny slice from the IPO allocation, barely 0.1% of my stock portfolio. Second, there’s still hope from those rumors saying the price will go up for whatever mysterious reason. If there were no rumors, I’d probably sell it already.”

A joke, sure, but the more I think about it, the more it makes sense. Hope,

even if built on shaky rumors, sometimes keeps you holding on. Maybe that’s what foreign investors aren’t getting from Indonesia right now, no whispers worth waiting around for.

Take the

banking sector, for example. One thing is clear in my opinion, there’s no exciting buzz or major plans that investors are eagerly waiting for.

Maybe “rumor” isn’t the right word; “plans” feels more fitting.

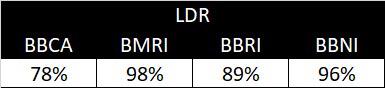

And that’s the problem. There’s just nothing thrilling on the horizon for Indonesian banks. Right now, it feels like we’re stuck with two types of bank;

the first one is banks that still optimistic about double digit loan growth but stressed out over liquidity. And the second one is banks with plenty of liquidity but too cautious to disburse loans.

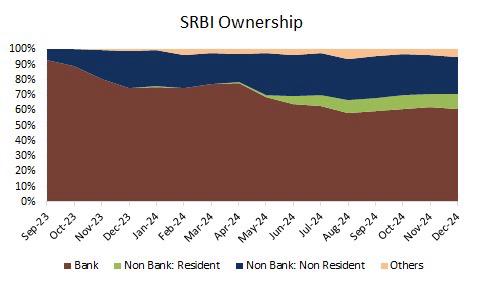

Banks that need liquidity are struggling to find it because

third-party funds are barely growing, people would rather park their money in SRBI or government bonds.

Meanwhile, banks with excess liquidity are cautious about lending. And who can blame them?

Their cost of funds is well-covered by safe government products like SRBI and bonds, so there’s no rush to disburse loans.

That’s why, in my opinion,

this situation will be tough to solve without the government stepping in directly.

If we look at the past few years, the

issuance of government bonds and SRBI has skyrocketed. Honestly, I get why it happens, but maybe the government needs to start limiting the ownership of these instruments by banks and local investors.

Over the weekend, I rewatched

Too Big to Fail. Paul Giamatti, playing Ben Bernanke, had a line that stuck with me: ”

I’ve studied the Great Depression my entire academic life. It may have started with the stock market crash, but what really crippled the economy was the credit dysfunction. Banks stop lending, people couldn’t borrow money, and small&medium businesses couldn’t finance their operations. Credit has immense power to drive economic growth, but a lack of credit can destroy an economy very quickly.”

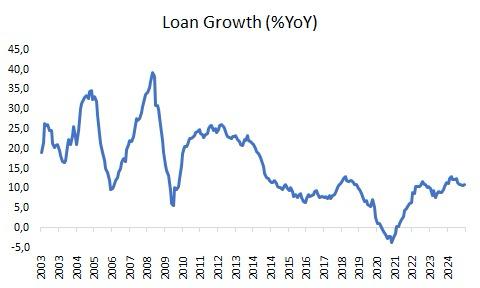

Like Ben Bernanke said,

loan growth is a critical factor for driving economic growth in any country. But in Indonesia, loan growth over the past decade has barely returned to the

15% level. Our 10year CAGR for loans is just around

10%, a far comparison from the previous decade’s comfortable

20%+ growth, which played a big role in pushing GDP growth above

6%.

Indonesia needs to get back to that level of loan growth.

Strengthening loan growth and fostering productive investments can revitalize economic momentum and attract foreign interest. With the right government policies, Indonesia has the potential to regain its competitive edge and fuel sustainable growth for years to come.

Instead of locking up liquidity in SRBI and government bonds,

perhaps the government needs to encourage funds to flow back into productive sectors through incentives or mandates. Create policies that make lending attractive again for banks while ensuring businesses, especially SMEs, can access capital.

Comments