29 December 2024

Goodbye and Thankyou

Market Commentary

0 comments

New year is just around the corner, and it’s often a time to start fresh, setting resolutions, making new goals, or simply taking small steps to try something different.

But if you think about it, there’s one thing we often overlook: the journey we’ve been through this past year. The experiences, the lessons, and even the mix of emotions that have accompanied us along the way.

For me personally, this year has been quite a colorful ride. It’s been a whirlwind of emotions, joy when gaining profits, frustration when taking losses, indecision about whether to buy or not, and hesitation on whether to sell or hold.

Sometimes I regret buying too late; other times, I regret selling too early. It feels like a roller coaster, much like the stock market itself. But that’s where the real lessons lie.

.png)

At the end of the day, every buy or sell decision comes back to us. The guidance is already there.

We’ve said, “Go for PTRO, RAJA, or buy ADRO to subscribe for AADI” The direction was clear. But in the end, execution is always in our own hands.

And that’s when I realized the market isn’t just about numbers. It’s about discipline, conviction, and the ability to manage emotions.

Every decision, good or bad, is part of a process that helps us become wiser for the next step.

So, before we step into the new year, let’s take a moment to reflect on what we’ve been through.

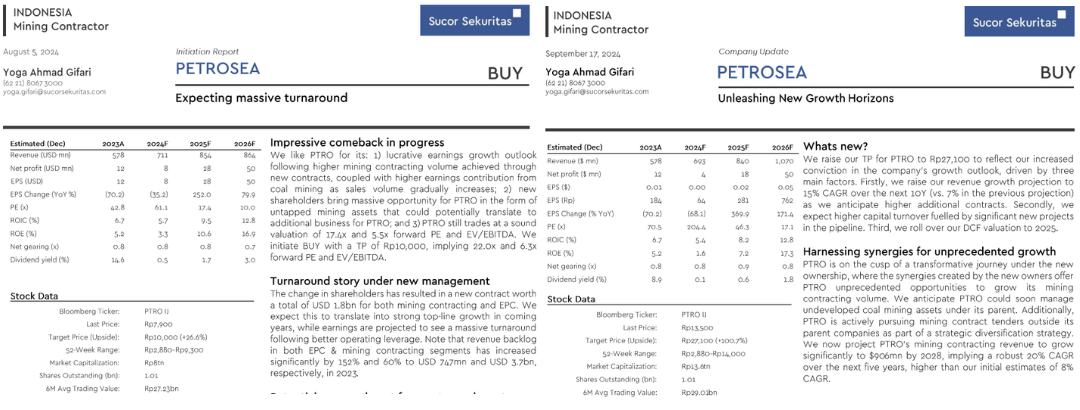

Let’s start with the stock that skyrocketed the fastest. We issued a BUY call for PTRO on August 5, 2024, with a target price of IDR 10,000. By September 17, 2024, we raised the target price to IDR 27,100.

And look at the results! The target price was finally hit.

Imagine if you had bought PTRO when we first gave the call on August 5 at IDR 7,075. By now, you’d have made a whopping 300% profit in just 4 months!

.png)

On the same date, August 5, 2024, we also released a report for RAJA. Back then, the price was at IDR 1,275. And look at it now, it has even surpassed our target price!

.png)

And here’s one more recent highlight. We recommended buying ADRO to subscribe for AADI.

Look at the results now, 35% dividend returns, plus gains from AADI shares. We’re still optimistic that AADI will continue to grow.

Our target price for AADI is IDR 30,100, and based on our track record, we’re confident this target will be achieved.

Sure, the market has been tough lately, but hang in there. Our blockbuster calls next year will bring us profits again. Just like our slogan at Sucor Sekuritas: Stronger Together.

New year, new strategy!

This time, we’re focusing on dollar earners because we believe the dollar will continue to strengthen. These companies have huge potential, but you still need to tread carefully.

Right now, sentiment towards the Rupiah isn’t great, so there might be some heavy selling before investors shift their attention to these stocks for the long term. So don’t rush, keep an eye on the movements!

.png)

This year’s journey wouldn’t have been meaningful without your support, our clients and colleagues who have always believed in us and stood by our side. Thank you for your trust. You’re the reason we stay motivated to face every challenge and opportunity.

Let’s welcome the new year with sharper strategies, renewed energy, and of course, exciting profits ahead!

Happy holidays, happy new year, and let’s make the next year extraordinary!

But if you think about it, there’s one thing we often overlook: the journey we’ve been through this past year. The experiences, the lessons, and even the mix of emotions that have accompanied us along the way.

For me personally, this year has been quite a colorful ride. It’s been a whirlwind of emotions, joy when gaining profits, frustration when taking losses, indecision about whether to buy or not, and hesitation on whether to sell or hold.

Sometimes I regret buying too late; other times, I regret selling too early. It feels like a roller coaster, much like the stock market itself. But that’s where the real lessons lie.

.png)

At the end of the day, every buy or sell decision comes back to us. The guidance is already there.

We’ve said, “Go for PTRO, RAJA, or buy ADRO to subscribe for AADI” The direction was clear. But in the end, execution is always in our own hands.

And that’s when I realized the market isn’t just about numbers. It’s about discipline, conviction, and the ability to manage emotions.

Every decision, good or bad, is part of a process that helps us become wiser for the next step.

So, before we step into the new year, let’s take a moment to reflect on what we’ve been through.

Let’s start with the stock that skyrocketed the fastest. We issued a BUY call for PTRO on August 5, 2024, with a target price of IDR 10,000. By September 17, 2024, we raised the target price to IDR 27,100.

And look at the results! The target price was finally hit.

Imagine if you had bought PTRO when we first gave the call on August 5 at IDR 7,075. By now, you’d have made a whopping 300% profit in just 4 months!

.png)

On the same date, August 5, 2024, we also released a report for RAJA. Back then, the price was at IDR 1,275. And look at it now, it has even surpassed our target price!

.png)

And here’s one more recent highlight. We recommended buying ADRO to subscribe for AADI.

Look at the results now, 35% dividend returns, plus gains from AADI shares. We’re still optimistic that AADI will continue to grow.

Our target price for AADI is IDR 30,100, and based on our track record, we’re confident this target will be achieved.

Sure, the market has been tough lately, but hang in there. Our blockbuster calls next year will bring us profits again. Just like our slogan at Sucor Sekuritas: Stronger Together.

New year, new strategy!

This time, we’re focusing on dollar earners because we believe the dollar will continue to strengthen. These companies have huge potential, but you still need to tread carefully.

Right now, sentiment towards the Rupiah isn’t great, so there might be some heavy selling before investors shift their attention to these stocks for the long term. So don’t rush, keep an eye on the movements!

.png)

This year’s journey wouldn’t have been meaningful without your support, our clients and colleagues who have always believed in us and stood by our side. Thank you for your trust. You’re the reason we stay motivated to face every challenge and opportunity.

Let’s welcome the new year with sharper strategies, renewed energy, and of course, exciting profits ahead!

Happy holidays, happy new year, and let’s make the next year extraordinary!

Written by Boris, the Broker

Comments