02 January 2025

Gem Starts Shining

Market Commentary

0 comments

Do you remember when I wrote about DEWA making headlines with plans to convert nearly IDR 1 tn in payables and loans through a private placement and convertible bonds?

Well, it’s happening now. This mining services company has just announced its plan to conduct a private placement by issuing 17.2 bn new shares at a price of IDR 65/share.

Two companies are participating in this corporate action: PT Madhani Talatah Nusantara (MTN), DEWA's creditor for trade payables amounting to IDR 757 bn, and PT Andhesti Tungkas Pratama (ATP), a creditor under other payables for IDR 358.9 bn.

Through this private placement, DEWA's debt to both companies will be converted into equity. In simple terms, the debt that once weighed DEWA down will transform into MTN's and ATP's ownership in the company. Once the transaction is complete, MTN will hold 29.8% of DEWA's shares, while ATP 14.2%.

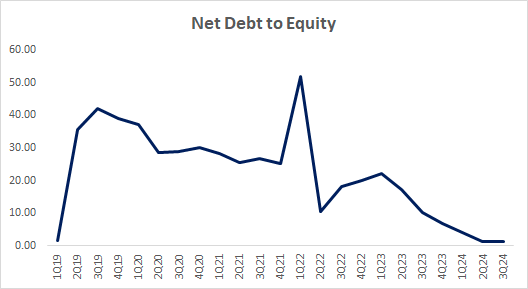

This move is expected to bring significant changes to DEWA. The company’s financial structure will become much healthier, with its DER dropping sharply from 1.32x to 0.73x.

With its debt burden alleviated, DEWA aims to optimize its cost structure and achieve greater cost efficiency, a critical focus area, as historical inefficiencies have hindered profitability.

Over the past five years, DEWA's financial performance has been underwhelming, with its EPS experiencing a 5 year CAGR decline of 9.8% and an average operating margin of only 1.4%, well below the industry norm of 3.52% from 2014–2018.

Despite these struggles, the company has demonstrated remarkable operational growth, with overburden volume increasing at a 13% CAGR, reaching 194 mn bcm in 2023.

This operational strength indicates that DEWA has been performing well at the production level but has been hampered by inefficiencies elsewhere.

The completion of this corporate action is expected to enable DEWA to capitalize on its operational growth more effectively. With a lighter debt load, the company can focus on streamlining its operations, reducing costs, and driving profitability

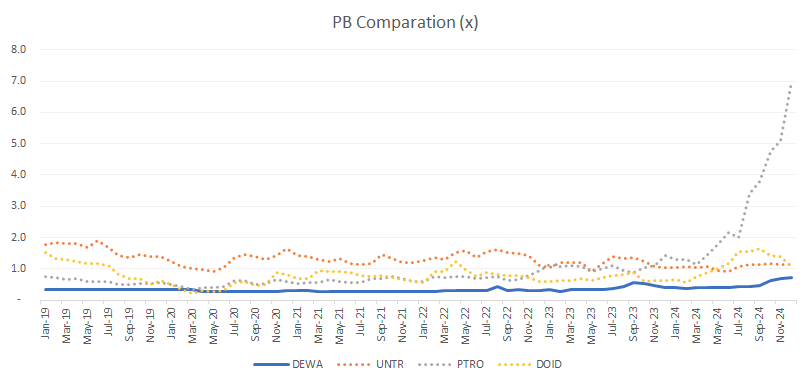

Looking at valuation, DEWA is “on sale” compared to its peers. Its PBV stands at just 0.7x, far below the industry average of 2.4x. This means DEWA's stock is significantly undervalued relative to its net assets.

Following the rights issue, at the current price, its PBV could drop even further to 0.58x, making it an even more compelling value play.

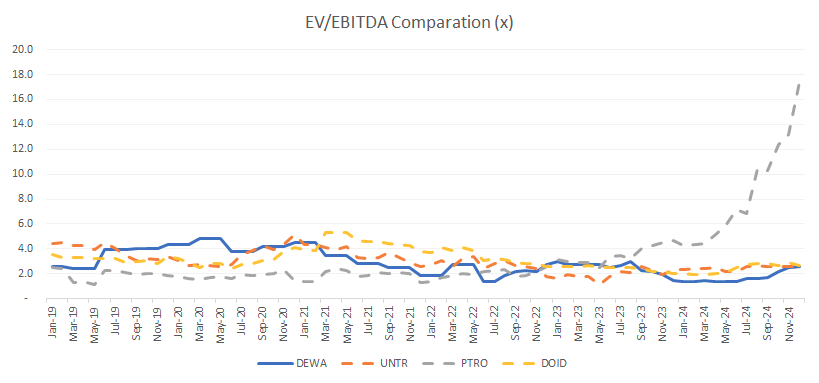

Additionally, DEWA’s EV/EBITDA ratio is very low at just 2.6x, compared to the industry average of 5.9x. This shows the market remains skeptical about DEWA’s performance, which has lagged behind larger players in the mining industry.

With such a low valuation, if DEWA manages to turn things around, whether through its gold mining expansion or ongoing financial improvements, the potential for a “re-rating” to a fairer valuation is massive.

If I previously said that DEWA was like a hidden gem waiting to be polished, now it seems this gem is starting to shine.

Well, it’s happening now. This mining services company has just announced its plan to conduct a private placement by issuing 17.2 bn new shares at a price of IDR 65/share.

Two companies are participating in this corporate action: PT Madhani Talatah Nusantara (MTN), DEWA's creditor for trade payables amounting to IDR 757 bn, and PT Andhesti Tungkas Pratama (ATP), a creditor under other payables for IDR 358.9 bn.

Through this private placement, DEWA's debt to both companies will be converted into equity. In simple terms, the debt that once weighed DEWA down will transform into MTN's and ATP's ownership in the company. Once the transaction is complete, MTN will hold 29.8% of DEWA's shares, while ATP 14.2%.

This move is expected to bring significant changes to DEWA. The company’s financial structure will become much healthier, with its DER dropping sharply from 1.32x to 0.73x.

With its debt burden alleviated, DEWA aims to optimize its cost structure and achieve greater cost efficiency, a critical focus area, as historical inefficiencies have hindered profitability.

Over the past five years, DEWA's financial performance has been underwhelming, with its EPS experiencing a 5 year CAGR decline of 9.8% and an average operating margin of only 1.4%, well below the industry norm of 3.52% from 2014–2018.

Despite these struggles, the company has demonstrated remarkable operational growth, with overburden volume increasing at a 13% CAGR, reaching 194 mn bcm in 2023.

This operational strength indicates that DEWA has been performing well at the production level but has been hampered by inefficiencies elsewhere.

The completion of this corporate action is expected to enable DEWA to capitalize on its operational growth more effectively. With a lighter debt load, the company can focus on streamlining its operations, reducing costs, and driving profitability

Looking at valuation, DEWA is “on sale” compared to its peers. Its PBV stands at just 0.7x, far below the industry average of 2.4x. This means DEWA's stock is significantly undervalued relative to its net assets.

Following the rights issue, at the current price, its PBV could drop even further to 0.58x, making it an even more compelling value play.

Additionally, DEWA’s EV/EBITDA ratio is very low at just 2.6x, compared to the industry average of 5.9x. This shows the market remains skeptical about DEWA’s performance, which has lagged behind larger players in the mining industry.

With such a low valuation, if DEWA manages to turn things around, whether through its gold mining expansion or ongoing financial improvements, the potential for a “re-rating” to a fairer valuation is massive.

If I previously said that DEWA was like a hidden gem waiting to be polished, now it seems this gem is starting to shine.

Written by Boris, the Broker

Comments