2024 is known as the "

Year of the Dragon" in the Chinese calendar, often seen as a

lucky year when many couples choose to have children.

However,

in China, birth rates didn’t rise as expected.

Many couples feel that raising a child is just too expensive.

According to a report from the YuWa Population Research Institute,

cost of raising one child up to age 18 in China is nearly 7x the average income, far higher than in other countries.

This is primarily due to two factors:

sky high housing prices, particularly in areas with good schools and facilities, and

hidden education costs, such as extracurricular activities and tutoring, which weigh heavily on household finances.

Even though the government has tried to regulate the property market and cut down on private tutoring, the problems are far from solved.

On top of this,

many people are hesitant to get married or have kids due to the high cost of living. In fact, the number of marriages in 9M24 dropped by

16%.

No wonder,

youth unemployment is another pressing concern. In June 2023, youth unemployment rate reached a record high of

21.3%.

While a change in calculation methods lowered the figure to

17.6% in September 2024, the rate remains alarmingly high.

Because of this,

purchasing power has weakened, as many people lack a steady income.

This was evident from

our team’s recent 10 day visit to Shanghai and Beijing to observe China’s economic conditions, where clear

signs of an economic slowdown were particularly noticeable in consumer spending.

Shopping malls and tourist spots in these cities were much quieter than pre pandemic times.

For instance,

Nanjing Road East in Shanghai and Sanlitun in Beijing, which used to be lively until late, now see shops closing earlier, and crowds thinning out before 10 pm.

National Bureau of Statistics data supports this. Before the pandemic, retail sales in China grew around

10% annually. After the pandemic, growth slowed drastically to just

3.8%/year.

We also spoke to locals, including

taxi drivers, shop owners, and attendees at local events. They all shared the same concern: the

economy feels sluggish, and many are saving more instead of spending because of future uncertainties.

This is backed by data from China’s central bank, showing household savings reached

9.2 tn yuan in 1H24, about

80% of household income. People are prioritizing saving over spending

As a result, China is facing an

oversupply problem in its manufacturing sector. With people struggling to earn and an uncertain economy, demand simply isn’t there.

China has also shifted focus to high tech industries like EV. But overinvestment has caused another oversupply issue, along with tougher competition within their domestic market.

One noticeable impact on Indonesia is the influx of cheap imports from China, which makes it hard for local producers to compete. This includes the automotive sector.

The entry of Chinese EV brands like

BYD, Wuling, and Chery has intensified competition in Indonesia’s automotive industry, especially in the EV segment.

This has put significant pressure on local players like

ASII, which currently lacks strong growth drivers.

But a breath of fresh air suddenly arrived, Toyota recently launched the

bZ3x, which is the cheapest EV car ever sold by Toyota, and it was first launched in China, the country of EV.

This is predicted to potentially give Toyota a chance and opportunity to get back in the game.

If we look at its price, which starts from

IDR 200 million to 400 million in China, it should be competitive with Chinese EV brands such as BYD. Hopefully,

it can be sold at the same price range if they decide to bring it to Indonesia, and eventually could be a great positive catalyst for ASII.

It’s too early to call, but it’s worth paying attention to its developments going forward.

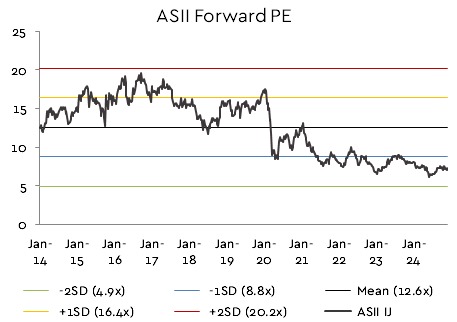

Currently

ASII trades at 7.6 forward PE

Comments